Compatible

Got a ton of Uber, Skip The Dishes and Lyft receipts?

No problem

Ride Receipts is a desktop app that helps rideshare users get their receipts in order for their taxes. It’s ideal for business owners on the go, self-employed professionals, and anyone who gets reimbursed for travel.

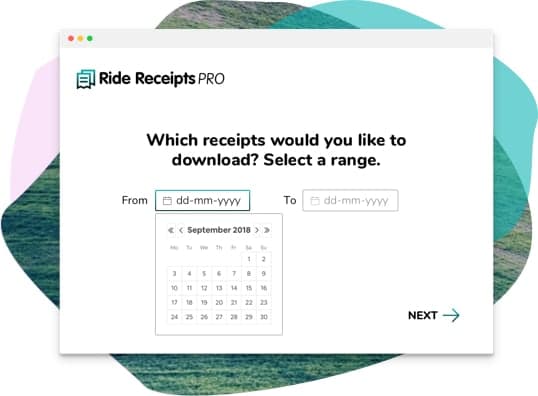

Set a custom date range

Ride Receipts makes bookkeeping, taxes and audits a breeze. Download your Uber, Skip The Dishes and Lyft receipts from as far back as you need with our new PRO version.

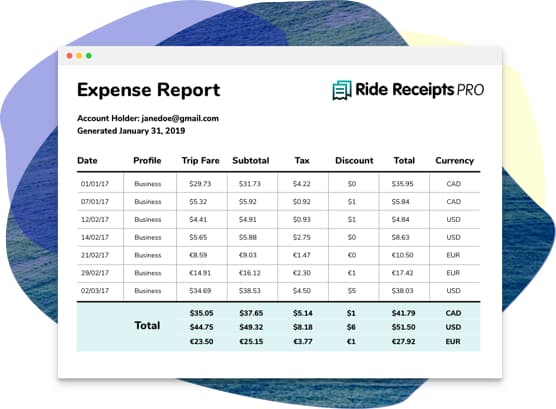

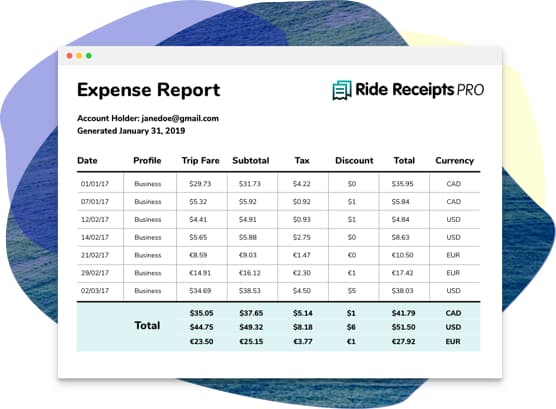

Get personalized expense reports

Save even more time with itemized Uber, Skip The Dishes and Lyft expense reports in Excel. Use it to keep track of your expenses, or send it off to your accountant for filing. See an exampleSee an example.

Ride Receipts PROStarting at $5/month |

| Trip filters |

| Full control over filters. Download trips from as far back as you need and set up a custom date range. |

| Expense report |

| You get a personalized expense report autogenerated in Excel, plus everything in the basic version. Ready for your accountant or bookkeeper. |

| Trip stats |

| Your itemized expense report includes each trip date, total, tax amount, and fees. Additionally, if you're using Uber, your receipts will be organized by business or personal profile. |

| Compatibility |

| Download Uber, Skip the Dishes and Lyft receipts from your Gmail (or Google business email) account, Microsoft email account (i.e Outlook, Live, Hotmail), or any email with IMAP support (i.e. Yahoo, iCloud, Fastmail). |

| New! Uber dashboard support |

| Includes a Chrome and Firefox extension to download invoices (where available) and receipts from your Uber dashboard. |

Ride Receipts PROStarting at $5/month | |

| Trip filters | Full control over filters. Download trips from as far back as you need and set up a custom date range. |

| Expense report | You get a personalized expense report autogenerated in Excel, plus everything in the basic version. Ready for your accountant or bookkeeper. |

| Trip stats | Your itemized expense report includes each trip date, total, tax amount, and fees. Additionally, if you're using Uber, your receipts will be organized by business or personal profile. |

| Compatibility | Download Uber, Skip The Dishes and Lyft receipts from your Gmail (or Google business email) account, Microsoft email account (i.e Outlook, Live, Hotmail), or any email with IMAP support (i.e. Yahoo, iCloud, Fastmail). |

| NEW! Uber dashboard support | Includes a Chrome and Firefox extension to download invoices (where available) and receipts from your Uber dashboard. |

How it works

The app will download the Uber, Skip The Dishes or Lyft receipts from Gmail/Google, Outlook/Microsoft, or any email with IMAP support. The files will automatically organize themselves in your Documents folder.

The app will download the Uber, SkipTheDishes, or Lyft receipts from Gmail/Google, Outlook/Microsoft, or any email with IMAP support. The files will automatically organize themselves in your Documents folder.

Enjoy neat and tidy file organization

Your receipts are organized in folders by month and year with custom file naming. Don’t waste time downloading everything one by one. We know you have better things to do. Like, literally anything.

News & Releases

Featured in:

Featured in:

-

-

-

-